By TBS Team | March 29, 2024

HDFC Securities is the stock broking subsidiary of HDFC Bank. Introduced almost 2 decades ago, as one of the best full-service stock brokers of India. HDFC Securities Blink is basically a terminal-based or browser based trading platform. It needs to be downloaded and installed on a computer system for usage. The installation process is quite easy and you just need to follow the given instructions.

In terms of usability and performance, the terminal-based trading application is truly impressive. However, there is only one concern with the application that is you need to pay subscription charge for a duration.

The subscription charges are:

6 months subscription fee – INR 2,999

1-year subscription fee – INR 3,999

Once you subscribe to the 6-month plan, you are expected to tell the support team that you are looking to extend the duration to 1 year before the plan expires. Otherwise, you might be charged ₹2999 instead of ₹1000.

This clause may be not feasible to many as most of the broking houses have been offering free terminal-based trading platforms to users.

Do you know?

HDFC Securities positions Blink is more of a market watch facility where you can create 5 market watch screens and can place orders in Equity and Derivatives market from the same screen.

System Requirement

Browser requirement: (1366 x 768 screen resolution in) Internet Explorer 10, Mozilla Firefox 21, Window Safari 5, Mac Safari 5, Google Chrome 26, Opera 15 onwards.

The facility is available for resident Indians only.

HDFC Securities Blink Trading Platform – Pros

Here is a list of amazing features of HDFC Securities Blink Trading Platform are:

- Receive information High low and best five buyers & sellers and option to buy & sell right on the same screen.

- Customized Trading platform to help traders take investment decision. They can also get access to the latest tips and research reports (across asset categories – Equity, currency, IPO, mutual funds) post technical and fundamental analysis respectively by the broker.

- Transaction monitoring – Traders can check Order Book, Trade Book, Net Position along with your portfolio summary.

- Single Screen to place the order in Equity and F&O, thereby, making the general usability experience tremendous smooth and seamless.

- Drag and drop level customization for your dashboard with minimum fuss.

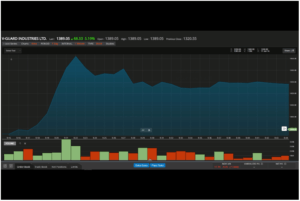

- Advanced charting features with diverse types of charts, technical indicators, option strategies in place for you. Within charting, traders can opt for a minute by minute market-movement for your technical analysis and can go back to the past 20 years for fundamental analysis.

- Real-time market quotes across different directories.

- Shortcut keys can be modified as per user preferences for rapid order execution or to access any specific features within the trading application.

Other benefits of HDFC Securities Blink:

- HDFC Securities Blink is known for excellent performance and speed. Therefore, as long as you have the given configuration, you will be able to access the application with hassle-free user experience.

- Extensive range of features available, particularly meant for heavy traders.

- Option to trade and invest across different trading and investment segments in one click

- Users can define different alerts and notifications as per their preferences to get quick reminders on their trading and investment plans.

- Since HDFC Securities is a full-service stockbroker, you do access to research reports and quick tips for your investment decisions (read HDFC Securities Research for more information).

Cons of HDFC Securities Blink

- Non-availability of trial is a matter of serious concern. This is particularly true as it is not a free trading application where anyone can register and deregister.

- Major concerns noticed in the usage of the ‘My portfolio’ functionality in regard to incorrect/invalid data, position etc.

- Comparatively complex to use for primary level traders or beginners.

- The application is available for Indian users only and cannot be used for NRI or foreign-based clients of HDFC Securities.

Other Important Article to Read: Zerodha Streak Review

Conclusion – HDFC Securities Blink Review

If you look forward to a smoother and simpler trading experience, HDFC Securities Blink is surely a way to go. And not to mention, you must be willing to pay the charges against registration.

As high frequency traders demand for high levels of perfection during stock trading, HDFC Securities Blink gives them an edge by ensuring seamless trading experience, though at a higher price.

And if you’re a beginner or medium level trader, it is better to look at other such options that are free of cost and lightweight too.

Disclaimer: This blog is written for educational purpose only. Data, Securities, Advisory and Quotes mentioned here are for guidance only. Doing research by investors itself is highly recommended.